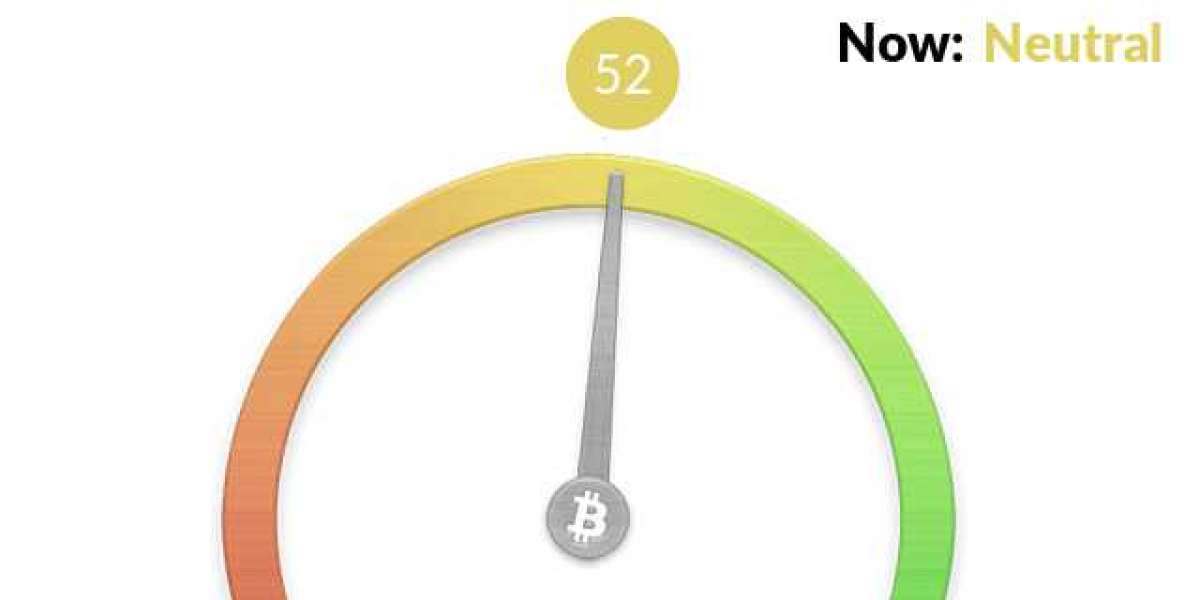

The Crypto Fear and Greed Index is an indicator that measures the overall sentiment of investors towards the crypto market.

The indicator spans from 0 to 100. The index scale can be divided into the following categories:

0 - 24 means Extreme fear (Orange)

24 - 59 means Fear (Amber/ Yellow)

50 means Neutral

51 - 75 means Greed ( Light green)

75 - 100 means Extreme greed (Green)

The Crypto market behavior is very predictable and emotional. Investors tend to be greedy when the market rises, which results to FOMO (Fear Of Missing Out) and consequently, the market move into correction.

The index scale value is calculated using these market factors:

1. Volatility (25% of the index)- this is calculated from the current volatility and the maximum drawdown of an asset, then comparing it with averages from the last 30 and 90 days . A rise is volatilty could be a sign of fear in the market.

2. Market Momentum/Volume (25% of the Index) - current trading volume and market momentum compared with last 30 and 90-day average value and then combined. High buying volumes in a positive market indicate that a market is overly greedy or too bullish.

3. Social Media (15% of the index) - this factor looks at the the interaction rate on social media. The social media platform usually used is Twitter, through the number of hashtag related to a cryptocurrency on the social media platform at a particular period.

Typically, a constant and unusually high amount of interactions relates more to market greed than fear.

4. Bitcoin dominance (10% of the index)- this factor indicates the dominance of bitcoin compared to altcoin. A rise in Bitcoin dominance is caused by a fear of too speculative altcoins. On the other side, when Bitcoin dominance shrinks, people are getting more greedy by investing in altcoins.

5. Google Trends (10% of the index) - thus is a is a general look at cryptocurrency search volume on Google. More search volume leads to a higher score on the crypto fear and greed index. This carries 10% of the weight of this index.

6. Survey results (15% Index Score). This input is currently paused and has been for some time.

Please, note that this is not a recommended advice and you are required to do your own research (DYOR)

Conclusively, the index can be used to traders’ advantage, but it is always important to rely on other tools for confirmation.

And it makes it that much easier to follow Warren Buffett’s words of wisdom, "Because it can be quite lucrative to be fearful when others are greedy and greedy when others are fearful".

Tolulope Shodeinde

1 Blog snips